Ehsaas Loan Program 2025 A Comprehensive Guide

Ehsaas Loan Program 2025 is a ray of light for many who want to come out from the financially suffocating cage and attain financial freedom. This is one of the programs under the umbrella of cracking poverty in Pakistan through offering loan aid without interest to the needy groups in the society to help them establish or extend their ventures. This article provides information on newer developments, how to apply, qualifications, and partnerships to help aspiring students understand everything there is to know.

EHSAS Interest-Free Loan Scheme – New Update

That is why, in 2025, some changes in the Ehsaas Interest-Free Loan Program were introduced to maximize its potential among the population. Some of the enhancements the new update provides include raising the loan limit to PKR 75,000 more to enable the provision of a more significant budget for young business people. Also, far-reaching change in the application has been made possible through efficient self-registration

a technique that heedless paperwork whilst improving transparency.

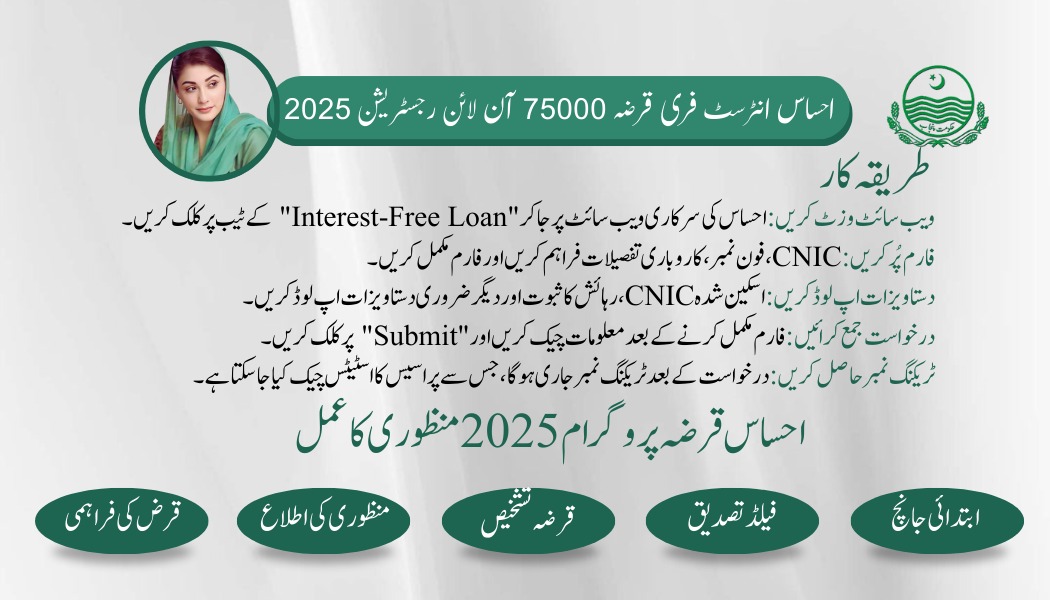

Ehsaas Interest-Free loan 75000 online registration 2025

A new online registration link is available to those intending to apply for the interest-free PKR 75, 000 loan. Here are the steps to register online:

- Visit the Official Ehsaas Website: Visit Ehsaas official website and click on the tab interest-Free Loan.

- Fill Out the Application Form: You have to give your CNIC number, phone number, and details of the business proposition or idea and the business that the applicant already has.

- Attach Necessary Documents: Yes for uploading scanned copies of CNIC, Proof of residenc,e and other necessary Documents.

- Submit the Application: Fill in the form and check the information entered after that press “Submit.”

- Await Confirmation: After the Victoria University application is submitted, one will be issued with a tracking number to check the application process progress.

Ehsaas Loan Program 2025 how it Gets Approval

The general features of the approval process of the Ehsaas Loan Program 2025 are also equally transparent and render justice. Here’s how it works:

- Initial Screening: Information and documents submitted by the applicants are used to determine their qualifications for or fitness for the position.

- Verification: The field officers of the Pakistan Poverty Alleviation Fund (PPAF) go to the applicant’s site for the purpose of detail verification.

- Loan Assessment: The feasibility of the applicant’s business plan in terms of financial profitability is discussed.

- Approval Notification: Applicants that are successful are contacted through the Short Messaging Service- SMS or e-mail.

- Disbursement: The granted credit is then disbursed among partner banks and microfinance organizations.

Online Portal that deals with Ehsaas Interest-Free Loan

The online application procedure for the Ehsaas Loan Program has been improved so that any person from all across Pakistan can apply. It has reduced instances where clients have to make visits physically and its flow chart indicates the process of making applications.

Key Benefits of Online Application:

Accessibility from remote areas.

Faster processing times.

Reduced likelihood of errors and omissions.

PPAF Loan Form Application Process

PPAF holds a central place in implementing the Ehsaas Loan Program of Pakistan. The loan form for the PPAF loan is available online mode as well as in the centers that have been set. Here’s a brief overview of the application process:

Obtain the Loan Form: You can download it from the official website or you also get it from the local offices.

Fill in the Details: Ensure that you give correct details on income, family, and how the cash will be utilized in the event you are granted the loan.

Submit at the Nearest Center: Duly complete the form with necessary attachments, then forward the form to the nearest PPAF office.

Follow-up: Keep track of your application status through the helpline or portal.

Filling up Application For Business Ehsaas Program Loan Scheme

The probability of getting the loans approved highly depended on the business plan, which was necessary to prepare well. Here are some tips:

Define Your Business Idea: I specifically quantify what your business is about, who your clients are, and what you want to achieve.

Estimate Costs: Come up with accurate figures in starting or expanding the business.

Highlight Profitability: Stand and elucidate on how the loan will go a long way in income generation as well as JOB CREATION.

Organize Documents: Original copies of documents including the business registration if applicable should also be availed to the authorities.

Ehsaas Loan Program 2025 Eligibility and Registration

The basic requirements of making the Ehsaas Loan Program accessible for Pakistan’s deserving population are clearly stated here. Here are the requirements:

Age: The applicant must be between 18 and 60 years for employment.

Income: Household income should be of PKR 25,000 per month or less.

Business Plan: This means that possessing a sound business idea is inevitable.

Residence: Depending on a specific georgaphic location, the applicant must be a resident of the country that is covered by that program.

Documentation: CNIC, utility bills such as electric bill or water bill, and other documents as and when needed are needed.

Clients can register through the Ehsaas online portal or by going to any of the centers.

Collaboration of Ehsaas Loan with Groups

The Ehsaas Loan Programme works in cooperation with community-based organizations, non-governmental organizations and microfinance banks for effectiveness on the field.These partnerships help:

- Identify eligible beneficiaries.

- Offer business education, training and support.

- Support loan disbursement process or the process of loan repayments tracking.

- Encourage group-based borrowing for mutual accountability.

Additional Features of Ehsaas Loan Program 2025

Skill Development: There are opportunities to have free trainings to improve on the existing entrepreneurial skills.

Women Empowerment: A good percentage of the loans is targeted at women businesspersons.

No Hidden Charges: There in full disclosure with no interest charged with none of the fees hidden anywhere.

Flexible Repayment Terms: Borrowers can pay back loans in simple quotational installments within a specified time only.

Conclusion

The targeted Ehsaas Loan Program 2025 is a revolutionary step in which emphasis is laid on economic as well as social liberalization. Interest-free loans enabled in the program help people improve their living standard, be financially independent, and foster employment along with the development of the nation. Whether you are an aspiring businessman or a business owner who wants to expand your business the Ehsaas Loan Program is one of the perfect chances that you can grab in order for your dream to come true.