CM Punjab Asaan Karobar Finance Loan Scheme 2025: A Complete Guide

Punjab Government stands as a leader in its constant support for entrepreneurial initiatives to boost economic growth. The CM Punjab Asaan Karobar Finance Loan Scheme 2025 represents an initiative that drew mass public interest. The CM Punjab Asaan Karobar Finance Loan Scheme 2025 exists to give money support to small and medium size businesses and starting entrepreneurs. This article explores the CM Punjab Asaan Karobar Finance Loan Scheme 2025 with its advantages for SMEs and entrepreneurs along with all requirements for participation and economic effects throughout Punjab’s market.

Let’S reveal the detailed instructions about the process of online application for the scheme.Punjab Government stands as a leader in its constant support for entrepreneurial initiatives to boost economic growth. The CM Punjab Asaan Karobar Finance Loan Scheme 2025 represents an initiative that drew mass public interest. The CM Punjab Asaan Karobar Finance Loan Scheme 2025 exists to give money support to small and medium size businesses and starting entrepreneurs. This article explores the CM Punjab Asaan Karobar Finance Loan Scheme 2025 with its advantages for SMEs and entrepreneurs along with all requirements for participation and economic effects throughout Punjab’s market. This article will include detailed instructions about the process of online application for the scheme.

What does Asaan Karobar Finance Scheme represent and what are its purposes?

The Asaan Karobar Finance Scheme serves as Punjab’s government flagship program which gives individuals and SMEs straightforward finance access. The primary objective of this program exists to develop entrepreneurship practices while lowering unemployment levels while strengthening local economic forces. The scheme supplies financing through adaptable requirements to eliminate financial obstacles facing business start-ups and existing ventures.

Features of the Asaan Karobar Finance Scheme

The scheme offers numerous accessibility and attractiveness elements to potential beneficiaries as follows:

This financial scheme offers loans to entrepreneurs with affordable interest rates which make it simpler for them to repay their debts.

Loan applicants can get either small or significant sums according to their business requirements through this program.

The application system requires basic documents which facilitates simple access to the process.

Online loan management combined with application services allows both steps to be handled digitally without requiring physical office visits.

Loan recipients obtain fast disbursement that lets them begin or advance their businesses swiftly.

The Asaan Karobar Card provides beneficiaries with a specialized financial access system to make transactions and use related services easier.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Eligibility Criteria for the Scheme

The scheme follows specific qualifications to identify the proper recipients which include:

A resident status in Punjab is required for the applicant.

Candidates between 21 years and 50 years old can apply for the scheme.

The funding application requires a reasonable business format illustrating planned uses for funding.

Good credit history together with a demonstrated capacity to handle financial responsibility is among the qualifications.

The program allows for preferential selection of certain sectors that include agriculture manufacturing retail and technology.

How to Apply Online for the Asaan Karobar Finance Scheme 2025

The process of scheme application remains basic through its digital application portal. Here is a step-by-step guide:

Users should access the Asaan Karobar Finance Scheme applications through the Punjab Government’s specific online platform.

Open a new account through the platform by entering your personal information together with your CNIC and contact details.

You should finish the online application form by providing precise information in all necessary sections.

You must upload digital versions of vital documentation which includes your CNIC along with residence proof and business plan.

Please finalize your application and perform the submission. The confirmation of your application will arrive through email or SMS.

The portal allows you to check on application progress through its tracking feature.

You will get approval notification after which the funds will be sent to your account selection either through your designated bank account or your Asaan Karobar Card.

Benefits of the Asaan Karobar Finance Scheme

The scheme generates various advantages which benefit individual recipients and the entire economy at large:

Through its financial backing the scheme enables people to transform their business concepts into actual commercial activities.

New businesses established through Asaan Karobar Finance create employment opportunities which decrease unemployment statistics in Punjab province.

The growth of Punjab’s economy benefits from the rising number of start-up business activities.

Through this scheme the formal financial system integrates underprivileged people who otherwise remain excluded from it.

Applicant training and mentoring are available through the program to multiple participants.

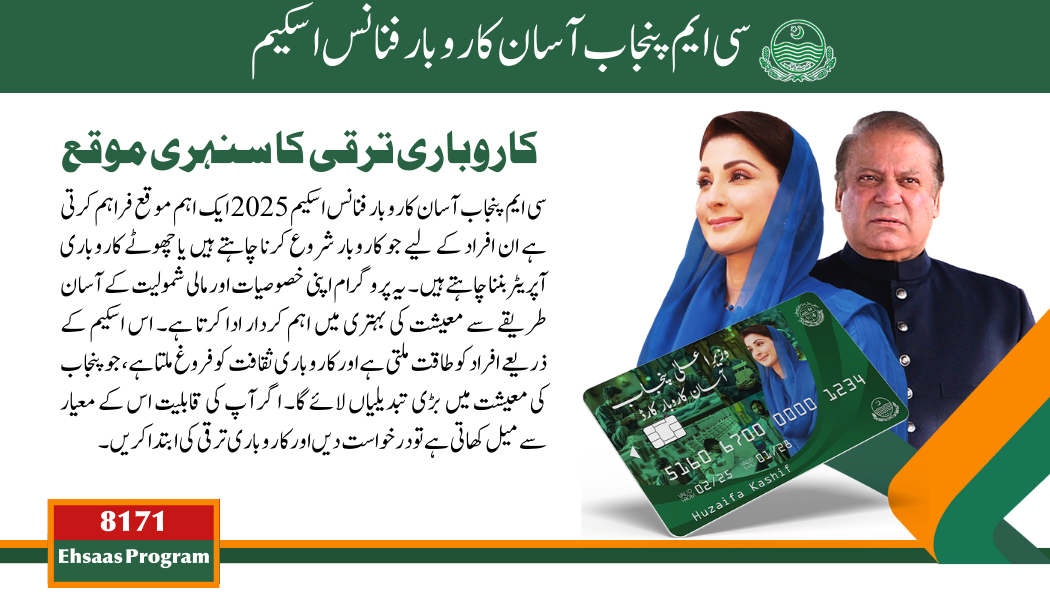

Asaan Karobar Card: An Additional Benefit

One unique feature of this scheme is the Asaan Karobar Card. This card functions as a multipurpose tool, offering:

- Instant access to loan funds.

- Discounts on business-related purchases.

- Priority access to government business development services.

- Tracking and managing loan repayments easily.

The card is a game-changer for beneficiaries, providing convenience and added value.

What Effects This Plan Will Have on the Economic Structure of Punjab

The CM Punjab Asaan Karobar Finance Loan Scheme 2025 will make major transformative changes to the economic environment of Punjab.

Local economic strength grows better due to backing small businesses at an improved level through this scheme.

Taxes will grow due to the formalization of businesses within the state.

The scheme provides financial power to communities which reduces their need to depend on social welfare programs.

Innovation and Diversification: Encouraging startups in diverse sectors fosters innovation and economic diversification.

Companies accepting financial aid can use their newly acquired resources to enhance product quality which results in increased competitiveness.

Conclusion

The CM Punjab Asaan Karobar Finance Loan Scheme 2025 acts as a vital opportunity for people who desire to become business owners or small business operators. The program functions as a major economic upliftment initiative through its features coupled with easy accessibility and financial inclusion approach. The scheme establishes power for individuals as well as promotes entrepreneurial culture that will drive major changes to Punjab’s economic structure. Make sure to file an application because the criteria match your qualifications to initiate business growth.

Read More:

FAQS

1. Who can apply for the Asaan Karobar Finance Scheme?

Anyone aged 21-50 years and a resident of Punjab with a viable business plan can apply.

2. What is the loan limit under this scheme?

The loan limit varies depending on the applicant’s needs and business plan.

3. Is there any collateral required for the loan?

Collateral requirements may depend on the loan amount and specific terms outlined by the government.

4. Can I apply offline?

Currently, the application process is primarily online to ensure transparency and ease.

5. What sectors are prioritized in this scheme?

Sectors such as agriculture, manufacturing, retail, and technology are given priority.